This page deals with the question of how to create PSID to pay your tax in 2022-23.

This is going to be a step-by-step guide.

Contents

- 1. What is PSID

- 2. How to create PSID

- 3. PSID payment online

- 4. PSID Challan

- 5. Frequently asked questions about PSID

- 6. Conclusion

What is PSID number

PSID is known as Payment Slip ID.

Remember when you have to pay your income tax other than what has already been deducted in your salary or any purchase or else, you have to create your PSID.

Once you have created your PSID now you can pay your tax anytime even with your mobile.

You can pay the tax against PSID through the following methods;

1. Easypaisa

2. JazzCash

3. Bank transfer

It is upto you which method you adopt but the point is tax payment becomes very easy for you.

How to create PSID

Creating payment slip ID is an easy job that will take your 5 minutes online.

Follow this step-by-step easy method;

1. Go to https://e.fbr.gov.pk/AuthLogin.aspx. it is the official website of FBR that gives you the service of creating payment slip ID.

2. Now go to the top menu and click on “e-Payments”. It shall open the dropdown and select your related option. Like; Federal Excise, income tax, income tax annual return, sales tax etc, as guided in the image below.

Image: e-Payment.png

3. It shall direct you to the e-Payment portal of Federal Board of Revenue (FBR).

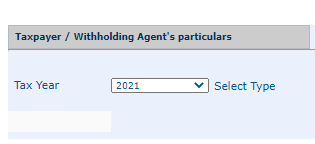

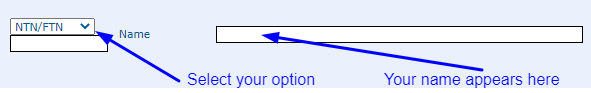

4. Select the Tax year first.

5. Now in the next step select your option as, NTN/FTN, CNIC or RegInc No. as guided in the image below. No sooner you give the number of your chosen option FBR system shall fetch your name and display it in the box next to it.

6. You your name is displayed and it means you are creating PSID on this page that relates to you.

7. Now give your particulars, like; “Tax Payment Nature”, and amount both in words and figures.

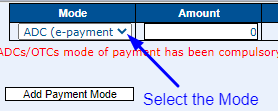

8. Next important step is the mode of payment.

Click on mode and select your mode of payment (credit card, cheque or cash) and amount again and click on “Add Payment Mode” button.

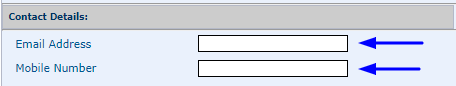

9. Give your email address and mobile number.

10. Once every particular is provided on the form now click on “Create” button.

You are done and your PSID (Payment Slip ID) is created.

Note: On different steps your system shall keep fetching your details and don’t worry it the process.

PSID payment online

Now here comes the one last step that how to pay the tax against the payment slip id that you have just created.

The best way to pay is the credit card mode.

You can pay either by Easypaisa, JazzCash or the bank app that allows you government payments through PSID. Here we shall guide you the steps to be followed in Easypaisa and JazzCash.

PSID payment through Easypaisa step-by-step

Now open your Easypaisa app in your mobile and follow the following step for payment.

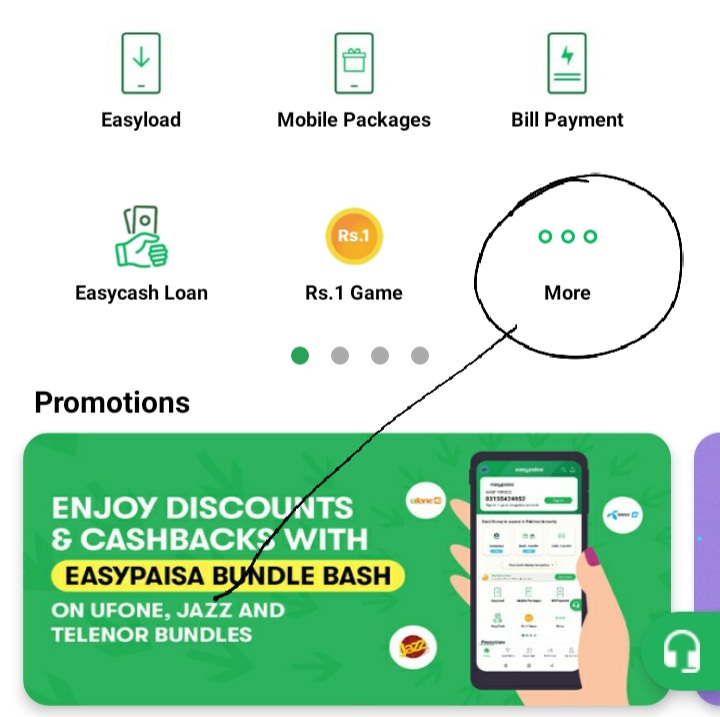

1. As a first step click on “More” option.

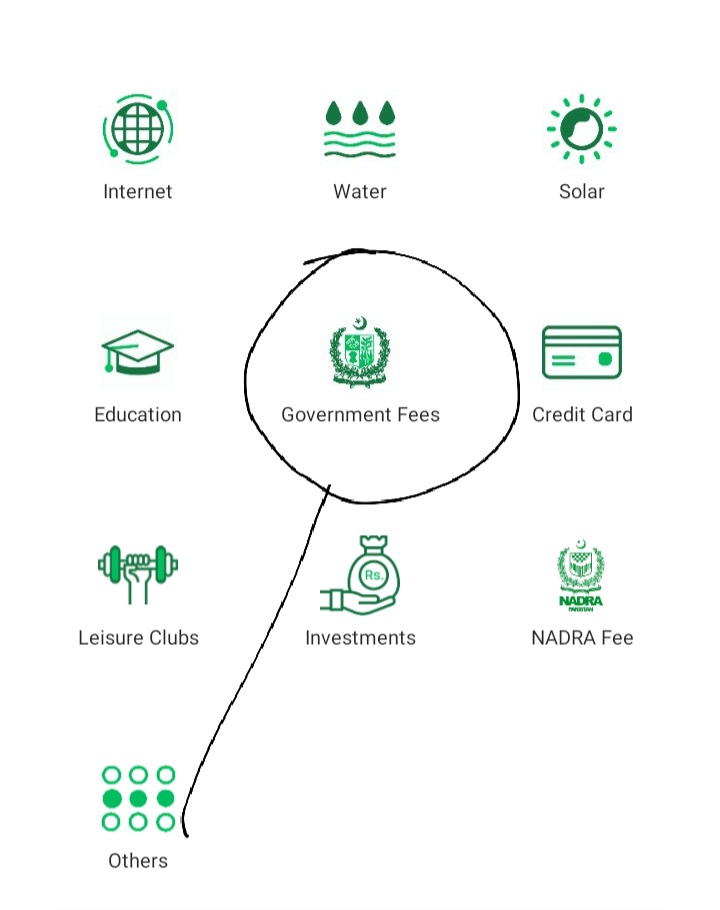

2. Go to the section of “Bill Payment” and click on “Government Fees”.

3. Now select either of the following options according to the nature of the payment to FBR.

Remember you have already created your PSID against any of the following options;

FBR Income Tax Annual Return

FBR Income Tax

FBR Sales Tax withheld

FBR Federal Excise

4. By selecting your option Easypaisa shall ask you for PSID. Give your Payment Slip ID number and click on “Next”. Your amount shall be paid.

5. Save “Transaction Successful” receipt and produce it to the concern quarter as a proof.

PSID payment through JazzCash step-by-step

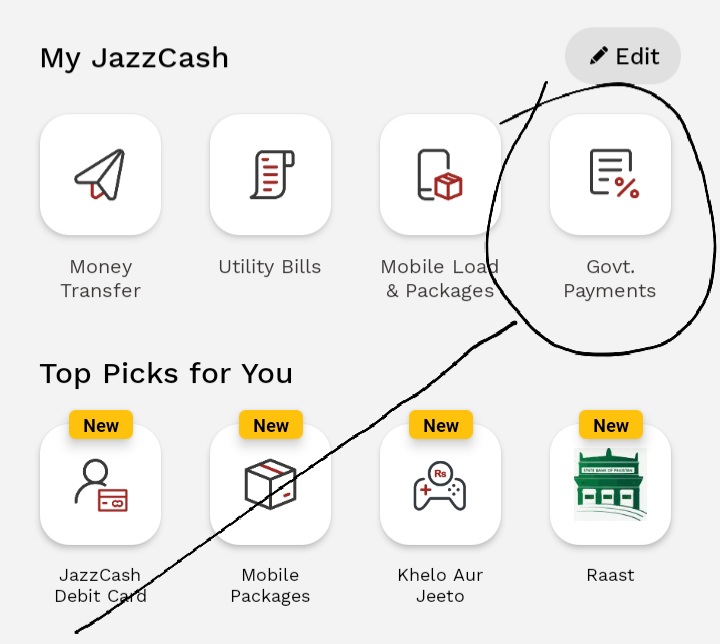

PSID payment through JazzCash is much easier than Easypaisa. Open JazzCash app in your mobile, login and then follow the two ssteps below;

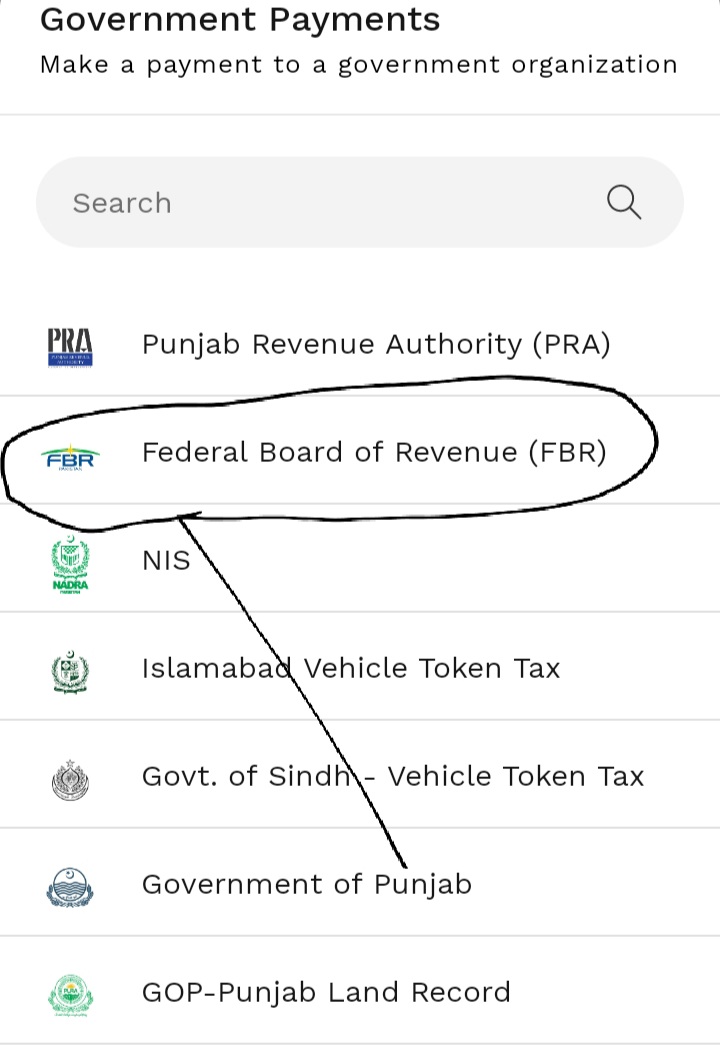

1. Click on the icon “Govt. Payments” and select “Federal Board of Revenue (FBR)”.

2. Now enter your PSID and it shall show you the payment. Just pay that and you are done.

PSID Challan

Yet another way to pay your tax through PSID is PSID Challan.

You can get the print of Payment Slip ID number or make note of it.

Go to the bank and pay PSID challan.

Frequently asked questions about PSID

Here is a satisfactory answer of the frequently asked questions about payment slip ID.

Q. What is PSID?

PSID is called Payment Slip ID. Whenever you pay your tax to FBR you are given a unique ID known as PSID. Your tax is collected against that ID. You can get it either from the Revenue office or create it on the official website of FBR.

Q. What is PSID payment?

PSID is the ID of the payment of your tax or any amount to FBR. There are three methods of payment against your payment slip ID. You can pay either through Easypaisa, JazzCash or bank challan.

Q. How do I get PSID number?

You can get PSID number from Revenue office but best way is to create payment slip ID online on the official website of FBR. Follow this method; 1. Go to https://e.fbr.gov.pk/AuthLogin.aspx. 2. Click on e-Payment. 3. Select the purpose of your payment and you will be directed to the form. Just fill in the form and click on “create” button. Your PSID shall be created. Now make the payment through easypaisa, jazzCash, bank app or bank challan.

Q. How can I get PSID for income tax?

In order to get your payment slip ID for income tax just follow these steps. 1. Go to https://e.fbr.gov.pk/AuthLogin.aspx. 2. click on e-Payment and select Income tax option from the dropdown. This will direct you to the form. Fill in the form and your payment slip ID shall be created.

Conclusion

Creating ID for your FBR payment is an easy job. Remember learn to do things by yourself. Just follow the easy steps on this page and you will learn what is payment slip ID, how to create it and how to make payment against your ID.

- FBR Registration and Income Tax Return

- Income tax finling FBR [Step-by-step Guide from A to Z]

- NTN verification FBR

- Income tax calculator FBR

- Income tax calculator FBR for business class

- Create PSID and make payment

- NTN Registration & Verification

- Normal return & Salary Return difference

- FBR: Weath statement problems & solutions

- How to receive salary slip on email every month

- How to see your filer status in ATL

- Income tax slabs explained for financial year 2022-23