Are you looking for information regarding NTN verification FBR [Urdu PDF + Video] in order to dig in to your tax information with FBR? Then you are at the right place.

We shall provide the desired information in easy to understand step by step manner in English, We have easy to follow Urdu downloadable pdf file on NTN verification and also a detailed video in Urdu on filing income tax. I am sure this shall help all the people with whatever their education and understanding capabilities. Let’s get started!

Note: if you have not registered yourself in FBR you better first visit our page on how to register in FBR

FBR NTN verification in many ways what we call NTN check.

Here you will get the complete and step-by-step method for the verification

of your NTN.

People usually don’t spare a time to tell these even simple things to an extent that people should be guided properly about their urgent matters as is the income tax.

Therefore our mission is to make people do their important jobs themselves by making things easier to understand.

This NTN verification FBR guide contains the following topics;

The table of contents

Contents of the page

1. What is NTN in Pakistan

2. Difference between Reference Number and NTN (national

tax number)

3. NTN verification online method

4 . NTN verification FBR Urdu PDF downloadable guide

5 . Frequently Asked Questions (FAQs)

6. Conclusion

7. Video on how to file income tax return

What is NTN in Pakistan

NTN is the national tax number which is issued to the people when they apply for FBR registration in order to pay their tax to Federal Board of Revenue.

When your earning becomes taxable you have to register yourself as a tax payer.

For that purpose you can either visit regional tax office (RTO)

for your registration or you can simply do it by visiting FBR web

portal

If you want to know the complete and easy method then please visit

FBR NTN Registration.

NTN registration, other words, is registration as taxpayer. Therefore on that page we have given complete information how to register yourself as a taxpayer on the website of FBR.

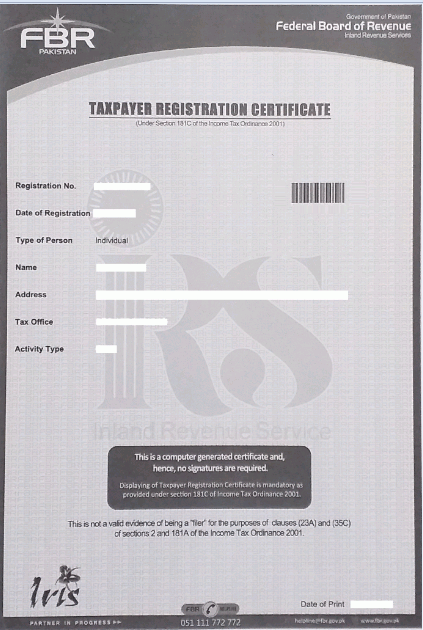

NTN certificate image

Difference between Reference Number and NTN (national tax number)

Remember, Reference number means NTN. They are one thing.

Now-a-days NTN certificates issued by FBR don’t have the word “NTN” rather you see “Reference number” and people become confused.

So remember, your NTN is now called reference number and they are one and the same thing as we said earlier.

It is so because changes are inevitable with the passage of time. So my advice is to keep in touch.

Therefore, if you are newly registered as taxpayer, your “Reference number” is your NTN.

NTN Verification Online method

Now it’s time to come to your main purpose of visiting this page and that is NTN verification because you have registered yourself and/or you have forgot your national tax number.

Whatever the case may be.

And now for the purpose of online verification of your National Tax Number on the website FBR you have to follow the step given below.

Follow these steps for NTN verification by CNIC, Passport number etc

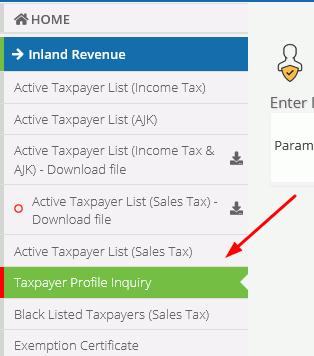

First of all visit FBR online verification services

This is the page for all types of online verification for taxpayers.

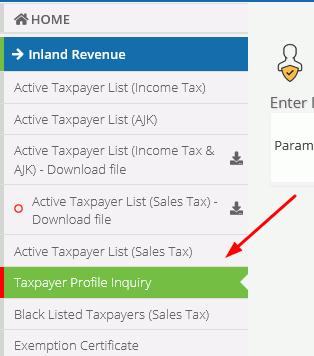

Because you have come here for the verification regarding your national tax number, go to the left menu and select the option “Taxpayer Profile Inquiry”.

This shall open up a short form.

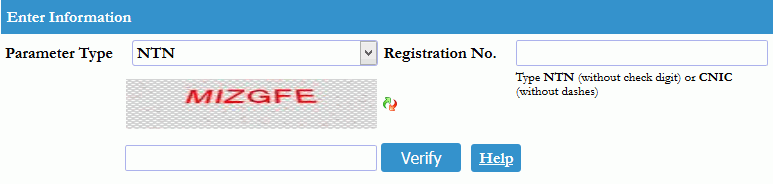

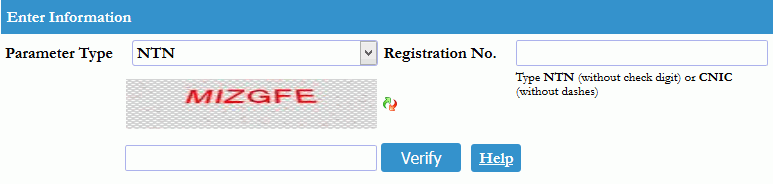

In the first bar of “Parameter Type” go to the drop-down menu and select the options as guided below.

Here you can have NTN verification by CNIC, Passport Number, STRN

etc

Now if you have selected “CNIC” give your CNIC number

in the box of “Registration No.”.

Other way round if you have selected “Passport No” then you have to give your Passport number in the box of registration instead.

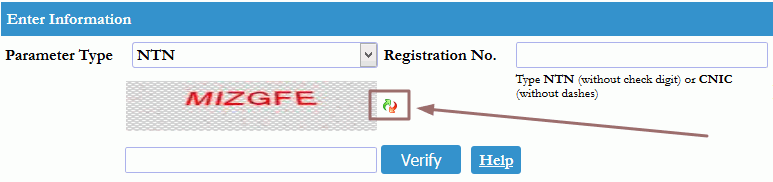

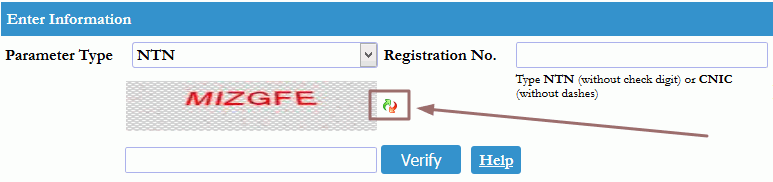

Once you have given these details now go to the captcha option and write down in the box below the same letters as you see in the captcha.

If you cannot see the letters properly you can refresh it by clicking on the following refreshing option.

Now give these letters / numbers in the box below and hit the enter key or click on “Verify” button.

No sooner you click on verify button FBR shall show your personal information that is stored on their website.

The given information shall be your registration number, Reference number or NTN, STRN, name, category, email, address, registration date, regional tax office (your concerned tax office) and taxpayer status.

NTN verification FBR Urdu PDF downloadable guide

این ٹی این کی ویریفکیشن کا آسان طریقہ کار

یہاں ہم آپ

کو این ٹی این ویریفکیشن کا تمام تر طریقہ آسان زبان میں سمجھائیں گے۔

این ٹی این کے ویریفکیشن کیلئے مندرجہ ذیل طریقہ کار اختیار کریں۔

سب سے پہلے مندرجہ ذیل لنک پر کلک کریں۔آپ ایف بی آر کے این ٹی این ویریفکیشن

کے آفیشل پیج پر آ جائیں گے۔

اس پیج پر بائیں جانب کے مینیو میں ٹیکس پئر پروفائل انکوائری پر کلک کریں جیسا کہ آپ کو نیچےتصویر میں دکھایا گیا ہے۔

نوٹ: اگر آپ موبائل استعمال کر رہے ہیں تو یہ مینیو پیج

کے اُوپر درمیان میں دی گئی تین لائینوں پر کلک کرنے سے کھلےگا۔

دُوسرے پیج پر سب سے پہلی آپشن پر کلک کر کے این ٹی این، سی این آئی

سی یا پاسپورٹ نمبر میں سے کوئی ایک آپشن سلکٹ کریں جیسا کہ تصویر میں

دکھایا گیا ہے۔

اب نیچے کیپچہ میں دیے گئے نمبر کو درج کریں اور ویریفکیشن کے بٹن کر کلک کر یں

اب آپ کی ساری انفارمیشن آپ کے سامنے موجود ہے۔اس میں آپ اپنا رجسڑریشن نمبر، ریفرنس نمبر اور دیگر تمام متعلقہ معلومات دیکھ سکتے ہیں۔

Download NTN verification PDF

Frequently Asked Questions (FAQs)

Following are the questions people usually ask for, in order to get more information regarding their income tax matters, and most importantly NTN verification.

We have answered them to the best of our knowledge.

Reading these questions throws some more light on NTN related issues, so its better if you spare more time to take a look at them.

How can I check my NTN number online?

Checking NTN number is what we mean the verification of NTN

You need to visit FBR verification portal. Click on “Online NTN / STRN inquiry”.

Select your CNIC from the drop down menu.

Go to “Registration No.” and in the box give your CNIC (without hyphens).

Give the captcha and click on “Verify” button.

Now the website shall show your data saved with them.

How can I know my NTN number by CNIC?

You can verify your NTN from CNIC number by adopting the above method.

Additionally you can also verify by giving the Passport number on online verification service of FBR. Please visit the link above.

Is NTN and CNIC number same?

No, NTN and CNIC number are not the same.

NTN is the national tax number having mostly 8 digits whereas CNIC number is the citizen number with 13 digits.

Anyway you can have NTN verified through your CNIC number.

How can I know my NTN number through SMS?

You can get your NTN number directly by going to online verification portal of FBR as guided above.

Link is provided for your convenience.

What is NTN certificate?

Federal Board of Revenue (FBR) issues NTN certificate at the time of your registration.

It contains your information and national tax number.

In the past FBR would issue and hard copy of certificate through regional tax offices upon your registration as taxpayer.

But now you have to download and print it at the time of registration.

In the new certificates, there may be no word like "NTN".

In that case you have to see your reference number.

Reference number is now your national tax number.

What is filer and non filer?

Filers are those people who have filed their income tax return of the current fiscal year.

Non filers are the people who didn’t file their income tax return of the current fiscal year.

Remember, if you are filer by regularly filing your annual tax return but you have, by any reason, missed it for one year, you will cease to be filer for that year unless you file it.

In short, the status of filer is associated with your filing of income tax for the current year.

In this connection please visit income tax filing FBR Complete guide form A to Z.

How to check FBR filer or non filer status?

FBR updates active taxpayer list every year on 1st of March.

If you have filed your income tax return you shall be declared filer in FBR list issued on the next March.

Now if you want to check whether your taxpayer status is active you can simply do that by the above mentioned procedure by visiting FBR online verification service.

How do I become a filer?

Once you file your income tax return you become filer and you will have active taxpayer status on the 1st March.

You can check your status by above mentioned procedure.

How I check my tax return status?

Check your tax return status by visiting FBR online verification service.

The link is provided above on this page.

How do I check my income tax refund status?

For income tax refund you have to visit your concerned Regional Tax Office (RTO).

Conclusion

On this page you have learnt the complete process of NTN verification

FBR.

Now you have read this page to the end you got to know many things

that a taxpayer should know.

This page guided you that if you don’t know your tax number or you have not recorded it with your for any reason it is not the matter of worry.

As long as you have your CNIC or Passport number you can verify and find out your NTN.

Remember, while filing income tax return you need not to give your national tax number anywhere and this is the point that people usually do not remember their NTN.

This number is required in many other cases and for that purpose you must know it.

If you are required to give your NTN somewhere then this page shall be useful for you.

Watch the video on how to file income tax return- FBR Registration and Income Tax Return

- Income tax finling FBR [Step-by-step Guide from A to Z]

- NTN verification FBR

- Income tax calculator FBR

- Income tax calculator FBR for business class

- Create PSID and make payment

- NTN Registration & Verification

- Normal return & Salary Return difference

- FBR: Weath statement problems & solutions

- How to receive salary slip on email every month

- How to see your filer status in ATL

- Income tax slabs explained for financial year 2022-23